How Forex CRM MT5 Integration Transforms Broker Operations

In today’s digital trading landscape, efficiency and seamless technology integration are essential for brokers aiming to maintain a competitive edge. For forex brokers working with MetaTrader 5 (MT5), a powerful CRM system tailored to their platform can make all the difference. Integrating a Forex CRM MT5 solution doesn’t just streamline operations—it enhances client satisfaction, improves compliance processes, and boosts overall profitability.

Understanding the Role of Forex CRM MT5 in Brokerage Ecosystems

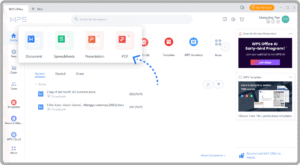

A Forex CRM MT5 solution is more than just a client relationship management system; it acts as the central hub for managing trader data, tracking performance, onboarding clients, handling support, and driving marketing efforts. When connected with the MT5 trading platform, this type of CRM creates a dynamic ecosystem where trade activity, user behavior, and client support intersect in real time.

By linking directly with MT5, the CRM can access live trading data, generate reports, monitor client activity, and facilitate smoother back-office operations. It eliminates the disconnect between trading activity and client communication, creating a more integrated and intelligent brokerage system.

Real-Time Trade Synchronization and Monitoring

One of the most powerful features of Forex CRM MT5 integration is real-time synchronization. Trade data from MT5 is automatically reflected in the CRM, allowing account managers and support teams to view client activity without having to switch platforms. This live feed empowers brokers to monitor active traders, analyze volume trends, and deliver faster, more informed customer service.

With synchronized trade history, brokers can also create automated notifications for margin calls, sudden losses, or milestone achievements. This allows for timely interventions that build trust and loyalty among clients.

Automated KYC and Compliance Handling

Forex brokers face stringent regulatory requirements, and failing to meet compliance obligations can lead to costly penalties. An effective Forex CRM MT5 solution should include robust automation for Know Your Customer (KYC) procedures, document verification, and Anti-Money Laundering (AML) checks.

Clients can upload their identification documents directly through the CRM’s client portal. The system then routes them through automated approval workflows, reducing manual workloads and speeding up account activation. With every new client, the system logs documentation status, audit trails, and compliance updates—all in sync with their MT5 trading accounts.

Streamlined Client Onboarding

Speed and simplicity are essential during the onboarding process. A CRM that integrates with MT5 ensures that once a client’s KYC documents are approved, their trading account is instantly created and linked within the MT5 system. This eliminates delays and improves the user experience.

Onboarding workflows can be customized to fit various account types, client jurisdictions, or promotional offers. Automation makes it easy to welcome traders with introductory emails, assign account managers, and activate trading access—without needing to toggle between systems.

Advanced IB and Affiliate Management

Introducing Brokers (IBs) and affiliate programs are vital revenue drivers for most forex brokers. A Forex CRM MT5 platform should offer a powerful multi-level IB management system that tracks referrals, calculates commissions, and supports transparent partner reporting.

With deep MT5 integration, the CRM can automatically track referred client activity such as trading volume, deposit frequency, or spread generation. The system can then allocate commissions based on predefined tiers and payout schedules. This enhances trust with partners and reduces administrative burdens associated with manual calculations.

Intelligent Reporting and Analytics

Data-driven decisions are critical in the forex industry. Forex CRM MT5 systems provide brokers with access to actionable insights through detailed dashboards and custom reports. These include metrics on trading volume, client profitability, churn rates, sales performance, and support response times.

The ability to generate real-time reports directly linked to MT5 data gives brokers a strategic advantage. From identifying top-performing traders to detecting unusual trading behavior, these insights support faster and smarter decisions across departments.

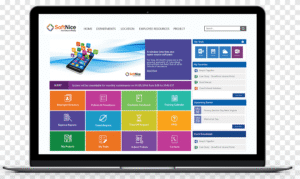

Multi-Currency, Multi-Language Support

Forex brokers often serve clients from around the world. A CRM built for global forex operations must support multi-currency transactions, multilingual interfaces, and localized communications. A good Forex CRM MT5 system ensures that all client-facing tools—portals, support chat, emails, and dashboards—can be adapted to the user’s language and location.

This level of localization creates a more personalized experience, increasing client satisfaction and trust while simplifying compliance with regional laws.

Built-In Ticketing and Customer Support Tools

Customer support plays a critical role in trader retention. Integrating support ticketing systems into the CRM means brokers can manage and resolve client issues more effectively. When this is paired with MT5 trading data, support teams gain instant access to client trade history, balance details, and recent activity.

This eliminates the need to ask repetitive questions or delay responses while switching between systems. With the full client context available within the CRM, issues can be handled faster and more accurately.

Marketing Automation and Client Engagement

Staying connected with clients through personalized and timely communication helps maintain engagement and drive trading activity. Forex CRM MT5 solutions often include marketing automation features such as scheduled emails, push notifications, SMS campaigns, and client segmentation.

Marketing teams can build campaigns triggered by specific trading behaviors—such as reaching a deposit threshold, going inactive, or closing their first profitable trade. These campaigns can offer rewards, educational content, or account reviews, all of which contribute to greater client retention.

Secure and Scalable Architecture

Security is non-negotiable in forex brokerage operations. A reliable Forex CRM MT5 system should offer enterprise-grade data encryption, user access controls, secure client portals, and regular system backups. As your brokerage grows, the CRM should be able to scale smoothly—handling thousands of client accounts and increasing volumes without slowing down.

Cloud-based CRM deployments are especially useful, offering flexibility and reducing infrastructure costs. The ability to integrate third-party tools via API also ensures future compatibility with emerging technologies.

Conclusion

Forex CRM MT5 integration brings a level of cohesion, speed, and intelligence that brokers need in today’s competitive market. From client onboarding and compliance to trade monitoring and marketing, the right CRM system serves as the operational backbone of a successful forex business.